In 2022, under the background of the “dual carbon” goal, the world is in an important stage of energy structure transformation. The superimposed conflict between Russia and Ukraine continues to lead to high fossil energy prices.

Countries pay more attention to renewable energy, and the photovoltaic market is booming.

This article will introduce the current situation and prospects of the global photovoltaic market from four aspects: first, the development of the photovoltaic industry in the world and key countries/regions; second, the export trade of photovoltaic industry chain products; third, the forecast of the development trend of the photovoltaic industry in 2023 ; The fourth is the analysis of the development situation of the photovoltaic industry in the medium and long term.

Development Situation

1. The global photovoltaic industry has high development potential, supporting the demand for products in the photovoltaic industry chain to remain high.

2. China’s photovoltaic products have the advantages of industrial chain linkage, and their exports are highly competitive.

3. Photovoltaic core devices are developing in the direction of high efficiency, low energy consumption, and low cost. The conversion efficiency of batteries is the key technical element to break through the bottleneck of the photovoltaic industry.

4. Need to pay attention to the risk of international competition. While the global photovoltaic application market maintains strong demand, the international competition in the photovoltaic manufacturing industry is increasingly intensified.

1. The development of photovoltaic industry in the world and key countries/regions

From the perspective of the manufacturing end of the photovoltaic industry chain, in the whole year of 2022, driven by the demand of the application market, the production scale of the manufacturing end of the global photovoltaic industry chain will continue to expand.

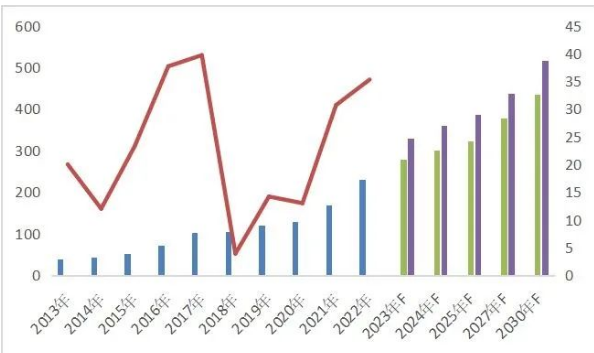

According to the latest data released by the China Photovoltaic Industry Association in February 2023, the global installed capacity of photovoltaics is expected to be 230 GW in 2022, a year-on-year increase of 35.3%, which will drive further expansion of the manufacturing capacity of the photovoltaic industry chain.

In the whole year of 2022, China will produce a total of 806,000 tons of photovoltaic polysilicon, an increase of 59% year-on-year. According to the industry’s calculation of the conversion ratio between polysilicon and modules, China’s available polysilicon corresponding to module production will be about 332.5 GW in 2022, an increase from 2021. 82.9%.

From the perspective of production layout, mainland China is still a gathering place for production capacity.

Silicon wafer production capacity accounts for 98% of the world’s total silicon wafer production capacity, cell production capacity accounts for more than 85%, and module production capacity accounts for about 77%.

In recent years, the global industrial center of gravity has also further shifted to mainland China. In 2022, the output of silicon wafers, cells, and modules in mainland China will account for more than 80% of the world’s total output, and it will show a rapid growth momentum.

From the point of view of the countries/regions of focus:

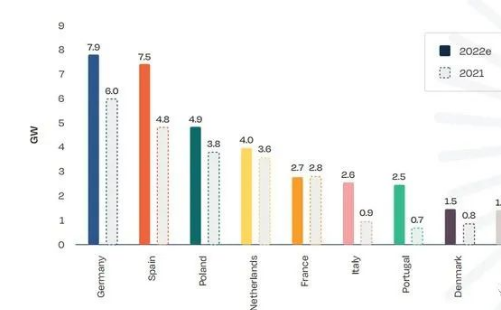

Europe: According to the data released by the European Photovoltaic Association, the 27 EU countries will add 41.4 GW of new PV installed capacity in 2022, a year-on-year increase of nearly 50%. It is optimistic that the annual installed capacity of PV will approach 120 GW in 2026. Among them, Germany ranks first with a new installed capacity of 7.9 GW in 2022; followed by Spain with a newly installed capacity of 7.5 GW.

It is estimated that Germany will add more than 10 GW of new installed capacity in 2023, and a total of 62.6 GW will be added in 2023-2026. Spain is expected to add 51.2 GW of installed capacity between 2023 and 2026, with cumulative installations increasing from 26.4 GW in 2022 to 77.7 GW.

In December 2022, the German parliament approved a new tax relief package for rooftop PV, including a VAT exemption for PV systems up to 30 kW. The newly revised German Renewable Energy Act (EEG) stipulates that from 2023, Germany allows all photovoltaic components of the original photovoltaic power plant, including modules, inverters, etc. . It is expected that the total installed capacity of photovoltaics in Germany will double after the implementation of the new policy.

Brazil: According to statistics from the Brazilian Ministry of Mines and Energy cited by Fitch, the total installed photovoltaic capacity in Brazil will reach 22 GW in 2022, with 9.0 GW of newly added capacity, a significant increase of 73.3% year-on-year.

Affected by the Distributed Power Generation Act introduced in January 2022, Brazil will begin to impose grid usage fees on small distributed projects in 2023.

Since the local distributed projects in Brazil account for more than 65% of the overall installed capacity, this bill is significant. Affecting the market and forming a large-scale rush to install, Brazil will become one of the hottest markets for photovoltaic installations in 2022.

India: According to the research data of JMK, an Indian photovoltaic consulting agency, in 2022, India will install 13.96 GW of solar photovoltaic systems, an increase of nearly 40% year-on-year. Among them, utility-scale photovoltaics were 11.3 GW, an increase of about 47% year-on-year, and some rooftop distributed photovoltaics and off-grid/distributed capacity.

Japan: According to statistics from Fitch and the U.S. Energy Information Administration (EIA), Japan’s installed photovoltaic capacity will reach 77.6 GW in 2022, a year-on-year increase of 4.4%, and the newly added installed photovoltaic capacity will be 3.1 GW.

In January 2023, the Tokyo Metropolitan Assembly voted and passed the revised regulations on “requiring that new houses in Tokyo must be equipped with solar panels from April 2025”, which stipulates that large residential buildings and a household with an area of less than 2,000 square meters Homeowners who build homes are obliged to install solar panels on their roofs. In addition, the Ministry of Economy, Trade and Industry of Japan will implement a policy starting from 2024 to purchase electricity generated by enterprises through rooftop photovoltaics at a high price, and plans to adopt a fixed-price acquisition system (FIT). 2 to 30%.

China: According to the data of the National Energy Administration, in 2022, China’s newly installed photovoltaic capacity will be 87.41 GW, a substantial increase of 59.3% year-on-year, and the growth rate has increased by 45 percentage points.

Distributed photovoltaics will become an important growth point for photovoltaic installed capacity; China Photovoltaic Industry Association predicts In 2023, the domestic newly installed photovoltaic installed capacity will be 95-120 GW, and in 2025, the domestic newly installed photovoltaic installed capacity will be 100-125 GW. It is expected that in 2023, the cumulative installed capacity of photovoltaics will exceed that of hydropower for the first time, becoming the largest non-fossil energy source of power generation.

According to incomplete statistics from the Photovoltaic Industry Association, a total of 18 photovoltaic-related policies will be issued nationwide in January 2023. Among them, there are 3 national policies and 15 local policies.

The content of the policy involves promoting the progress and industrial application of smart photovoltaic technology, encouraging and supporting industrial and commercial users of 10 kV and above to directly participate in the electricity market; guiding the balanced development of solar photovoltaic, energy storage technology and products, and avoiding overcapacity and vicious competition.

United States: The U.S. photovoltaic market is one of the few markets to experience recession. As trade restrictions on China hinder the import of key low-cost spare parts and materials in photovoltaic equipment, the new installed capacity of solar energy in the United States in 2022 is estimated to be 23% lower than that in 2021. %.

For all enterprises in the photovoltaic industry chain, in the context of high demand for downstream installed capacity, leading manufacturers have shown a more stable performance growth rate. 2022 is a big year for “cross-border” photovoltaics of major listed companies. Judging from the performance performance that has been disclosed so far, most “cross-border light chasers” have not yet realized their photovoltaic business revenue.

Leading photovoltaic enterprises have scale advantages, first-mover advantages, and continuous expansion of production capacity, which puts greater pressure on photovoltaic enterprises and second- and third-tier manufacturers that enter the market later. The large scale and low cost of integration may make the profits of some links more concentrated, the trend of the strong becoming stronger will become more and more obvious, and the trend of reshuffle of small manufacturers may gradually appear.

2. Export trade of photovoltaic industry chain products

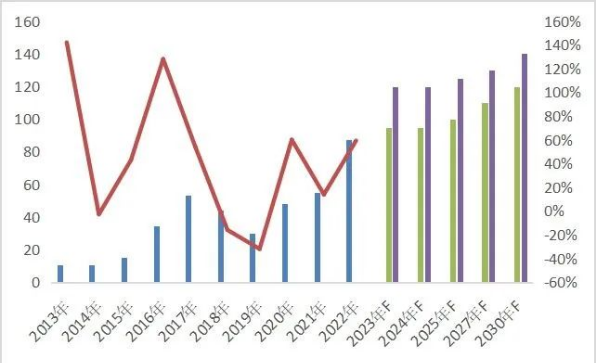

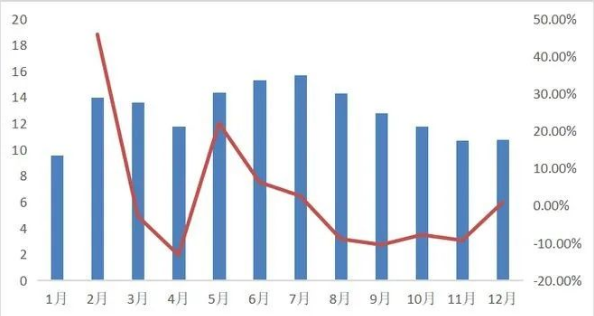

China: In December 2022, China’s photovoltaic module exports rose slightly against the trend, ending the downward trend since the export peak in July. The annual export data is outstanding.

In 2022, the export volume of photovoltaic modules will reach 154.8 GW, an increase of 74% compared with 2021; the export value will be 42.375 billion US dollars, a year-on-year increase of 65.45%.

The export peak is from May to July in the middle of the year. After that, due to the large amount of imports in the first half of the year, the inventory level increased, and the pull of goods slowed down. The export volume of modules continued to decline until November, and then stopped falling and rose in December.

Europe: In the whole year of 2022, countries in the European region imported 86.6 GW of photovoltaic modules from China, accounting for 56% of China’s export volume of photovoltaic modules for the whole year, and a substantial increase of 112% compared with 40.9 GW in 2021.

It is the fastest growing and largest regional market for China’s module exports in 2022. In 2022, due to the impact of the conflict between Russia and Ukraine, the price of traditional energy will rise rapidly, prompting European countries to actively promote energy transformation, and the demand for photovoltaic equipment installation will increase significantly.

The demand in major countries such as Germany, Spain, Poland, and the Netherlands will increase significantly. Countries with smaller needs also saw multiples.

Asia-Pacific region: The Asia-Pacific region will import 28.5 GW of photovoltaic modules from China in 2022, an increase of 27% compared to 2021. Major demand countries include India, Japan and Australia.

Americas: In 2022, the total amount of modules imported from China will reach 24.8 GW, an increase of 50% compared to 2021, and 80% of the increase will come from Brazil.

Middle East: Typical countries are the United Arab Emirates and Saudi Arabia. The volume of photovoltaic modules imported from China in both countries will increase significantly in 2022. Among them, the UAE imported 3.6 GW of photovoltaic modules from China, an increase of 340% compared with 2021, making it the largest importer of Chinese modules in the Middle East; Saudi Arabia imported 1.2 GW of photovoltaic modules from China, compared with 2021. Substantial demand growth of less than 0.1 GW in 2021.

In addition to components, in 2022, China’s accumulative export of solar cells will be 4.003 billion US dollars, a year-on-year increase of 40.66%; the cumulative export of inverters will be 8.975 billion US dollars, a year-on-year increase of 75.11%.

3. Prediction of the development trend of photovoltaic industry in 2023

The trend of opening high and moving high continued throughout the year. Although the first quarter is usually the off-season for installed capacity in Europe and China, recently, the new production capacity of silicon materials has been continuously released, resulting in a downward trend in the price of the industrial chain, effectively relieving downstream cost pressures, and stimulating the release of installed capacity. At the same time, overseas photovoltaic demand is expected to continue the trend of “off-season not weak” in January in February-March.

According to feedback from leading component companies, after the Spring Festival, there is a clear trend of increasing component production schedules. The average month-on-month increase in February is 10%-20%, and the month-on-month increase will further increase in March. Starting from the second and third quarters, with the continuous decline in supply chain prices, demand is expected to continue to rise until the end of the year or there will be another wave of large-scale grid connection, driving the installed capacity in the fourth quarter to reach the annual peak.

Industry competition is becoming more and more fierce. In 2023, factors such as geopolitics, the game of great powers, and climate change will continue to interfere or affect the entire industrial chain and supply chain, and the competition in the international photovoltaic industry will become increasingly fierce.

From the perspective of products, increasing the research and development of efficient products is the main starting point for improving the global competitiveness of photovoltaic products; from the perspective of industrial layout, the future trend of photovoltaic industry supply chain from centralization to decentralization and diversification is becoming more and more obvious. According to different market characteristics and policy situations, scientific and reasonable layout of overseas industrial chains and overseas markets is a necessary means for enterprises to enhance global competitiveness and reduce market risks.

4. The development situation of the photovoltaic industry in the medium and long term

It is an irreversible trend to transform the structure towards diversification, cleanliness and low carbonization. Governments of various countries actively encourage enterprises to develop the solar photovoltaic industry. In the context of energy transformation, combined with the positive factors of the reduction in the cost of photovoltaic power generation brought about by technological progress, in the medium term, the demand for overseas photovoltaic installed capacity will continue to maintain a high boom. According to the forecast of the China Photovoltaic Industry Association, the global newly installed photovoltaic capacity will be 280-330 GW in 2023, and the global newly installed photovoltaic capacity will be 324-386 GW in 2025, supporting the demand for photovoltaic industry chain products to remain high. After 2025, considering the factors of market consumption and supply-demand matching, there may be a certain excess capacity of global photovoltaic products.

China’s photovoltaic products have the advantages of industrial chain linkage, and their exports are highly competitive. my country’s photovoltaic industry has the advantage of the world’s most complete photovoltaic industry supply chain, complete industrial supporting facilities, a linkage effect between upstream and downstream, and obvious advantages in production capacity and output, which are the basis for supporting product exports. At the same time, my country’s photovoltaic industry continues to innovate, and its technological advantages lead the world, laying the foundation for seizing opportunities in the international market. In addition, digital technology and intelligent technology have accelerated the digital transformation and upgrading of the manufacturing industry, greatly improving production efficiency.

Photovoltaic core devices are developing in the direction of high efficiency, low energy consumption, and low cost, and battery conversion efficiency is a key technical element for breaking through the bottleneck of the photovoltaic industry.

On the premise of balancing cost and efficiency, once the battery technology with high conversion performance breaks through and realizes mass production, it will quickly occupy the market and eliminate low-end production capacity. The product chain and supply chain balance between the upstream and downstream of the industrial chain will also be reconstructed accordingly.

At present, crystalline silicon cells are still the mainstream technology in the photovoltaic industry, which also constitutes a high consumption of upstream raw material silicon, and perovskite thin film cells, which are considered to be the representative of the third generation It has significant advantages in consumption and other aspects.

At present, this technology is still in the laboratory stage. Once a technological breakthrough is achieved and the replacement of crystalline silicon batteries becomes the mainstream technology, the bottleneck of raw materials in the upstream of the industrial chain will be broken.

It is necessary to pay attention to the risk of international competition.

While the global photovoltaic application market maintains strong demand, the international competition in the photovoltaic manufacturing industry is increasingly intensified.

Some countries are actively planning the localization of photovoltaic industry manufacturing and supply chain, and raising the development of new energy manufacturing to the government level, and there are goals, measures, and steps. For example, the U.S. “2022 Inflation Reduction Act” plans to invest 30 billion U.S. dollars in production tax credits to promote the processing of solar panels and key products in the U.S.; The “National Plan for Efficient Solar Photovoltaic Modules” was announced, aiming to increase local manufacturing and reduce import dependence in the field of renewable energy.

At the same time, out of self-interest, some countries have introduced measures to restrict the import of photovoltaic products from my country, which has a certain impact on the export of photovoltaic products in my country. However, in terms of the time period, it will take at least two to three years for these countries to establish a complete photovoltaic industry chain.

During this period, they still need to import overseas products to support the development of domestic infrastructure. At the same time, considering the matching factors of market supply and demand, before 2025 will be the golden period for the development of the domestic photovoltaic industry, and it will also be the window period for enterprises to expand production.